3 questions to ask before diving into blockchains that handles fast & cheap transactions

Now I’m sure most of you have always been trying to look for “the fastest and cheapest blockchains” and comparing each blockchains in the “Transaction-per-Second (TPS)” & transaction fees metrics.

While speed & cost are important metrics towards building a highly scalable blockchain, they are definitely not the only two metrics that determine the scalability of a blockchain.

Before we start to heap praises on any particular fast & cheap blockchains, we need to ask ourselves these few questions:

Does that particular blockchain solved the issue of spam & network congestion?

Does that particular blockchain figured out how to prevent state bloating?

Is that particular blockchain truly decentralized while being able to scale to billions of users at the same time?

1) Spam & Network Congestion

Let’s start with the first point about spams & network congestion, or a Distributed Denial-of-Service (DDoS) attack. Here’s a brief overview of how DDoS works in blockchains. When you have a blockchain that possess high transaction speeds, spam and DDoS attacks are more likely to occur as they can slow down blockchain speeds by overwhelming the network with a large number of transactions or requests.

Just imagine a blockchain like a digital racetrack where transactions or requests race to be processed. When someone sends a transaction, it needs to be added to the blockchain, and it takes some time for that to happen. However, if someone sends a huge number of transactions all at once, like a flood of cars on the racetrack, it can overwhelm the blockchain. The network becomes busy dealing with all these transactions, and it slows down. It becomes difficult for new transactions to get processed quickly, and everyone has to wait longer for their turn.

Blockchains & other distributed ledger technology (DLTs) such as Nano, IOTA, Solana, Arbitrum & Harmony ONE have experienced network congestion with great effect due to them offering negligible or no-fee transaction features, while boasting a high transaction outputs.

Nano’s mitigation plan is to implement a feeless, spam-resistance transactions whereby transactions are prioritized by the sum of the balance and the time since the last transaction. The quote from the article states that:

If a spammer needs to get their transactions prioritized over legitimate transactions, they would need to either hold a large NANO balance (to which they are strongly disincentivized from trying to harm the network, or use smaller sums but only be able to spam infrequently or ineffectively.

For Solana, a blockchain which boasted average transaction fees of 0.000067 SOL ($0.0014 as of May-2023) had a DDoS attack back in 14-Sept-21 whereby a launch of a new project caused a surge of transactions as high as 400,000 transactions per second, causing the validator nodes to run out of memory & crashed. For their mitigation plan, the community proposed a hard fork from the last confirmed slot that required at least 80% of active stake to reach consensus, thus it took 14 hours for engineers to sort out their issues and restarted the network.

For IOTA, a Distributed Ledger Technology (DLT) that is based on a Direct Acyclic Graph (DAG) protocol that charges no fees and allows for 1,000 transactions per second, they have an algorithm called the IOTA Congestion Control Algorithm (ICCA) which comprises a scheduler, rate setter, and blacklister to regulate network access, ensure fair and secure message propagation while also protect against congestion and spam in the IOTA network.

For Harmony ONE, a Proof-of-Stake (PoS) sharded blockchain with negligible fees & fast transaction speeds, also suffered an outage before back in Jan-2022 due to heavy spam traffic for the past 30 hours, thus their mitigation plan is to increase the minimum gas fee.

From these examples, we can summarize that very fast & cheap blockchains or DLTs do have challenges to overcome the issues of spams & network congestions, mostly either by increasing the gas fees, or to update their code further to mitigate spam in a smart manner. Therefore, it’s important to evaluate that the blockchain you invested which boasts high transaction speeds & low cost is resilient enough to handle spam & DDoS attacks.

2) State bloating

As more and more transactions are added quickly to a blockchain, the amount of memory it needs to store all transactional data into the blockchain state can grow really fast. This is a concern for blockchains that aim to be fast and cheap. Let's take a look at the sizes of some blockchains as of June 2, 2023, to understand the issue better:

Bitcoin = Approximately 485GB

Ethereum (Archive Node) = Approximately 14,400 GB

Cardano = Approximately 118GB

Polygon MATIC = Estimated to be over 1,269 GB

Solana = Estimated to be over 100,000 GB

While blockchains such as Polygon & Solana do not publish their blockchain size online, so only rough estimates can be included here, we can at least get an idea that if you’re running a blockchain that can processed very high amounts of transactions, you may need to invest in more expensive node hardware that can handle the continuous growth of the blockchain size to store those transactions, thus causing nodes to take longer times to download the copy of the blockchain state and sync to the network.

Despite this, there are definitely workarounds on this issue. For Ethereum blockchain, there are 3 different types of nodes: Full, Light & Archive Nodes. Users that run full nodes normally need to store the full blockchain data, though it’s periodically pruned so a full node does not store all the state data all the way from the genesis block, which makes it faster to sync the blockchain state to the node. For Ethereum’s case, the full node only stores the last 128 blocks in their disk.

The current and historical states will be stored in an Archive Node instead, whereby archive nodes require even higher computation memory to operate. The functionality of an archive node is pretty limited, as regular Ethereum usage does not require accessing to historical data in an archive node, but will only be useful to make queries about historical states that full nodes does not have.

As for light nodes, they only process block headers, which basically stores a portion of a block containing the information about the block, such as a timestamp, hash of previous block’s header and a cryptographic nonce. This will allow nodes to sync up quickly to the blockchain while significantly reduce the memory requirements for running node, which makes it suitable to be run even on mobile devices.

By using different types of nodes, blockchain networks can strike a balance between storage requirements and synchronization speed. Thus, you’ll need to verify your blockchain of choice if they have different types of node clients to ensure faster sync time to handle transactions from billions of users.

3) Decentralization vs Scalability

Continuing the talk about scaling up to billions of users, many people have talked about the blockchain trilemma, especially when it comes to the debate between scalability and decentralization.

Scalability refers to the ability of a blockchain network to handle a large volume of transactions quickly and efficiently. Higher scalability allows for faster transaction confirmation and higher throughput. On the other hand, decentralization refers to the distribution of power and control across multiple nodes in the network. A highly decentralized blockchain involves a larger number of nodes participating in the validation and consensus process, which ensures security, censorship resistance, and resilience against attacks.

The tradeoff arises because achieving high scalability often requires compromises in decentralization. As the number of transactions and network participants grows, the consensus process becomes more complex and resource-intensive. This can lead to slower transaction confirmations and increased costs. To address scalability challenges, some blockchains may introduce measures like sharding, off-chain solutions, or layer-two protocols, which can improve scalability but may require some level of centralization or sacrifice certain decentralization properties.

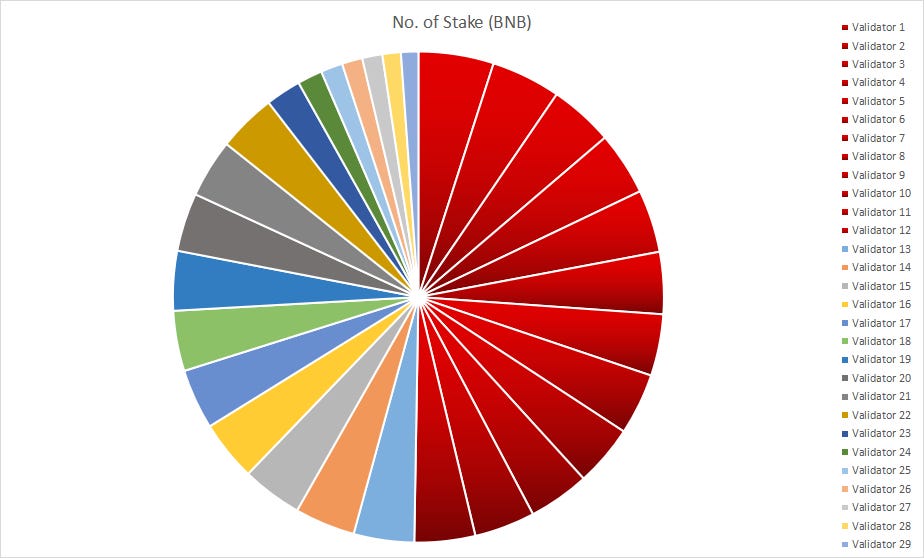

Take Binance Smart Chain as an example. Binance Smart Chain has a block time of around 3 seconds, so the transactions on BSC can be confirmed and finalized relatively quickly compared to some other blockchain networks. However, BSC only has a total of 29 active validators with a total of 22 Million BNB (14% of total supply) worth of voting power. According to my calculations, you’ll only need the top 12 validators to perform a 51% attack. If all validators are owned by Binance, that means you’ll only need to take control of Binance to be able to prevent new transactions confirmation and reverse them to perform double-spending.

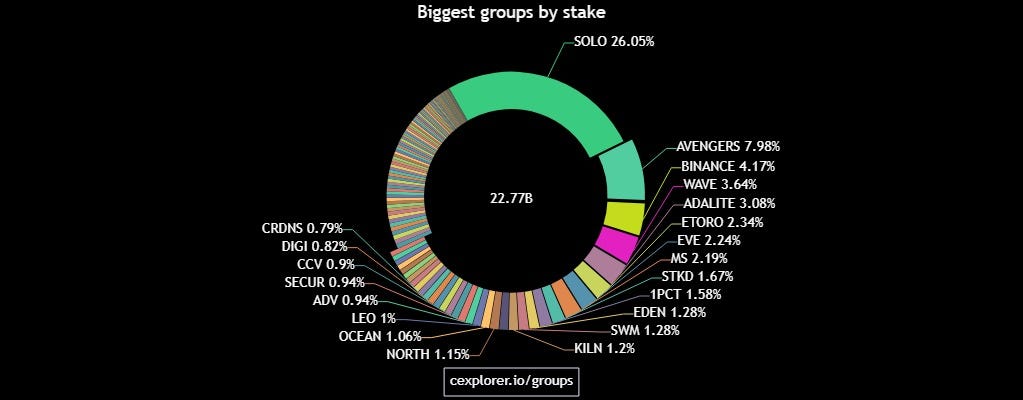

Conversely, take another example of Cardano. Cardano’s block time is around 20 seconds, so transaction confirmations are slower than other fast blockchains like BSC. However, they have a total of 3,186 validator pools with a total of 22.8 Billion ADA (63% of total supply) worth of liquid (not locked) voting power. To perform a 51% attack on Cardano, you’ll need to collude with 34 different entities, a lot of them in different geographic locations. This shows their resiliency towards centralized attacks even though with slower transaction speeds.

Of course there are many blockchains that claimed that they have solved the issues of making their blockchains fast & cheap, with a good amount of decentralization such as Solana, Cosmos, Avalanche, Elrond and Algorand. In the end, it’s up to you to decide if you’re okay with some form of centralization properties for the sake of fast speeds and low costs.

Summary

Spams, blockchain state bloating and level of decentralization are the top 3 questions you should know before you dive into a fast and cheap blockchains. While there may be other properties that I didn’t mention here, these 3 questions will be a good benchmark to choosing the right blockchain for you.

Personally, blockchains that have very high speeds & very low transaction costs are mostly suitable for people who likes to do short & frequent trades with their cryptos or NFTs. If you’re a person who just buys and holds, paying a bit of transaction fee while waiting for a few minutes for a transaction to go through doesn’t really matter much as long as the fundamental properties of blockchain such as security, decentralization and sovereignty are embedded in their DNA.

Feel free to share other properties that determines a great blockchain in the comments down below!

Subscribe to my Substack newsletter to receive quality crypto articles from a Malaysian’s perspective in your email!

Consider donating an affordable, decent meal monthly to support and grow my content further so that I’m able to introduce more features for the newsletter in the future!