A) Background Story

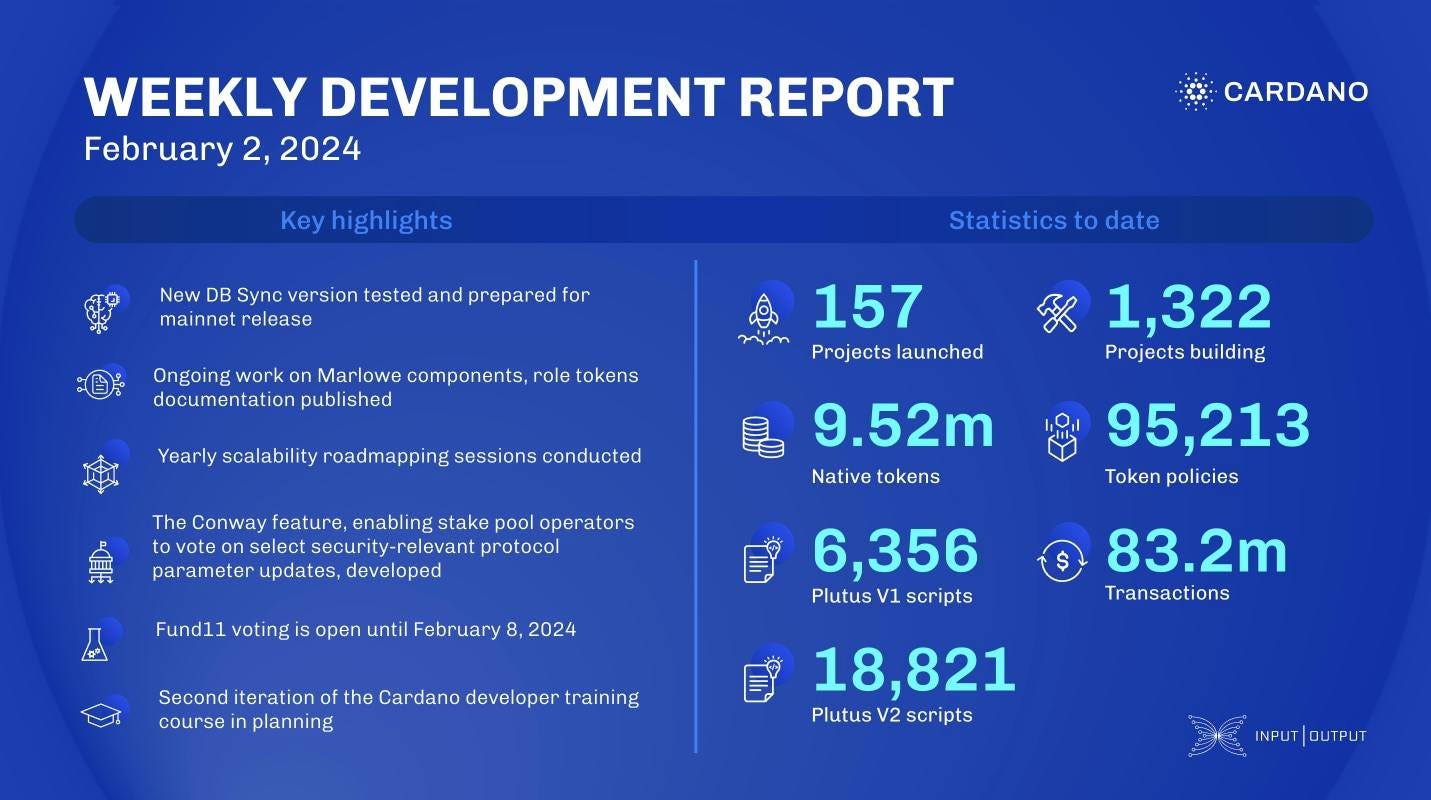

I first got into Cardano back in the year 2020 when Shelley mainnet went live. Back then, I watched Charles’s whiteboard video, read the Cardano documentation, waited hours for Daedalus wallet to load up, tried out their delegation feature, spent a lot of time researching different mission-driven stakepools, seeing Cardano progress through Mary, Alonzo, Vasil hard forks and then until today with 153 projects launched & 1.3k project still building as of December 2023.

For the past 4 years, I still find the people-proclaimed “ghostchain” to be one of my most favourite blockchain I’ve tried compared to the other 20+ L1 & L2 blockchains that I’ve experienced.

Before I get into the details, I want to stress out that no blockchains are perfect, as Cardano does have their downsides (to which i’ll cover in a Part 2), and different users will have different opinions on which chain suits them the most.

B) 9 Main Points “Why Cardano for me”

1. Native Assets

Cardano is utilizing a native asset system where each token in the Cardano ecosystem feels like a real token that you hold & spend like real money & stuff in the digital world. This is quite different to Ethereum & other EVM ecosystems, whereby the tokens are represented in multiple standards such as ERC-20 (fungible like your Ringgits) & ERC-721 (non-fungible like the NFT pic of your crush) that requires complex smart contract code to transfer these tokens around the ecosystem, which may result in errors, possible bugs & more headaches for the developers to verify the vulnerability of the smart contract code.

With ADA and other tokens in the Cardano ecosystem, all your tokens behaved just like BTC, where it feels like cold hard cash that you can send & receive money around without the need of smart contracts. No need to approve for other DApp or DeFi platforms to spend your crypto unexpectedly, so the token design is much more efficient & resilient to unexpected hacks.

Which also brings to my next point.

2. Felt Secure

Out of all the L1 blockchains I tried, UTxO-based blockchains that utilises similar native asset designs & has transactional predictability like what Cardano has, does made me feel safe in storing my own wealth, due to the fact that you can read & predict how the transaction will behave before signing the transaction. If the transaction fails, your funds will be refunded to your wallet. In addition, your funds doesn’t leave your wallet unintentionally unless if you accidentally sign a malicious transaction without double checking.

It’s a different feeling compared to using Ethereum or other EVM-based chains, because of their smart contract design that requires token approvals, I need to always revoke my token approvals just to feel safe, which requires additional transaction fees & extra steps which worsens the user experience.

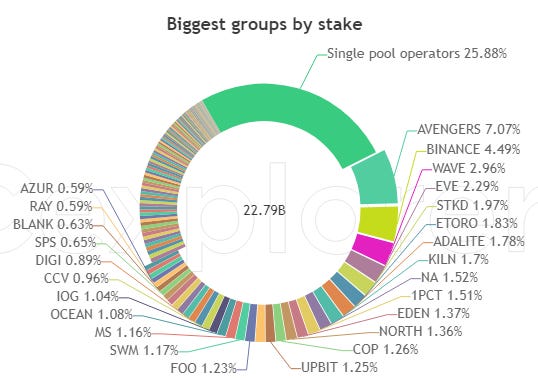

3. Very Decentralized SPO network

I love this donut chart. It still represents one of the best features of Cardano, whereby Cardano not just have around 2,500 SPOs & 924k active delegators securing the network, the stake delegation is also distributed to these thousands of pools.

Furthermore on Cardano, you have better information about whom you’re delegating to, as most of the pools have names & websites that give you some introduction on their pools and a lot of them are mission-driven to do charities, carbon offsetting their footprint and raise money to develop platforms with utility. In contrast, other POS validators are normally run by larger validator service entities, and some may not even have a name or who is the person running the validator to which you can only see a validator ID instead, thus I find Cardano’s validators to be more trustable in that you don’t just know who you are delegating to, but you can build a closer, peer-to-peer relationship with the stakepool operator.

4. ADA Staking/Delegation with Excellent UI & No Locking

What makes Cardano stands out from most L1 PoS blockchains out there is that your ADA delegated to a stakepool is not locked, meaning you can freely send & receive your ADA while it’s being delegated to a pool and earning rewards every 5 days at the same time. This is totally different to a liquid staking derivative model (LSD) like stETH where your ETH is staked to a centralized provider for your LSD to be minted.

In addition to not needing an LSD, delegating your ADA to stakepools is more efficient than the usual staking to validators in other PoS blockchains.

For example, this is the usual process of staking & redelegating your stake to another validator in most L1 PoS blockcahins:

Stake/Delegate → Claim Rewards → Unstake/Undelegate → Restake/Redelegate.

Each of these steps incur tx fees. As for Cardano, you only need to register a staking key and your ADA rewards are automatically accumulated in your wallet once you’re delegated to a pool, and you don’t need to undelegate or unstake to redelegate to another stakepool. Heck, you don’t even need to think about undelegating forever! This makes the delegation process much more straightforward & way more efficient than other PoS chains, while minimizing tx fees to claim rewards, to unstake and also no unbonding time.

5. Cheap and Predictable Tx Sending Fees

Sending ADA around is actually pretty cheap, which normally costs in between 0.16 ADA to 0.20 ADA (11 cents to 10 cents assuming ADA = $0.70). Another advantage over Ethereum’s tx fee model is that Cardano’s tx fees are calculated using a popular high school math of [y = a*x +b]

Whereby,

y = transaction fee in ADA; a & b are constants; x is basically transaction size in bytes.

Meaning, there is a linear relationship between tx size & fees, so the higher the tx size, the higher the fees. Therefore, it’s predictable & calculatable as long as you know how big is your tx size.

Meanwhile in Ethereum, because the fee model is unpredictable, you need to set a maximum gas limit and the tx fee they showed you before you approve it is just an estimation that you’re “most probably” going to pay this amount of tx fee to process your tx. Then, if you checked your transaction history, you’ll notice the fees consumed slightly differs to what you saw before you approved (it can go higher or lower). For Ethereum L1, it’s much more critical because the tx fees normally cost > $1, but for L2s, sidechains and other EVM L1s, they normally costs in cents but sometimes can be much higher depending on network traffic.

Not to mention that for Ethereum or other EVM chains, if your transaction computes & fails, you’ll still be charged a tx fee for the failed transaction. With Cardano, there’s still a possibility that you’ll be charged for a failed transaction. However, you’re able to know in advanced if your transaction will fail before you submit a transaction, which gives the user a better piece of mind.

6. Vibrant, Well-Balanced DApp, DeFi & RealFi Ecosystem

Sorry “Cardano is a ghostchain” and “Cardano has no DApps” folks, Cardano actually has a well-diversified DApps and DeFi ecosystem, coupled with tons of RealFi solutions.

I covered a detailed list of DApps, DeFi & RealFi platforms in the Cardano ecosystem in a Twitter thread here back in Sep-2023 (List is slightly outdated, will update with a new list).

In summary, there’s a total of 157 projects launched with more than 1,300 projects still building, this includes 10+ DEXes & aggregators, 30+ DeFi, DAOs & Launchpads and many more cool stuff building on Cardano.

One of the major reason why I stayed in Cardano is because the DApps currently building in Cardano are interesting & innovative enough to keep me engaged in learning how they are leveraging the eUTXO technology to create unique ways of implementing DeFi in a UTXO setup. I’m also an advocate to investing in projects that are solving real world problems, to which Cardano has many projects that are focusing on that, and it’s pretty much aligned to my investment philosophy. Most L1 blockchains, especially chains that use EVMs, have mostly DeFi products, DEXes, stablecoins, NFTs & memecoins that are pretty repetitive and doesn’t really attract me much.

7. Innovative DeFi Solutions with Very Smart Community Devs

As mentioned just now, all DeFi ecosystems in other blockchains will at least have the basics of DEX swaps, aggregators, lending, NFT marketplace and many more. However, Cardano’s unique stakepool delegation & the eUTXO accounting model also brought many unique DeFi solutions such as:

a) FluidTokens’ Boosted Stake: Users are able to lend their ADA into a liquidity pool to which the borrower (which are the stakepool operators) in return can borrow ADA from this pool to boost their delegation power to validate blocks and earn ADA rewards. No liquidation, SPOs pay interests upfront, and lent ADA not spendable & only used to boost stake.

b) Axo trade: An innovative crypto exchange platform that has features that is very closed to a professional centralized exchange, but decentralized in a way that no account registration or KYC is needed to use the exchange. The unique feature of Axo is that you can create your own trading strategies in that you program when you buy or sell an asset according to certain conditions, such as trading volumes, RSIs, Moving Averages, or even emotional sentiment. In addition, if you don’t like coding, you can visualize your trading strategy in a mind-map style and just input your parameters. I’ve also created a thread on Axo here.

c) ADA delegation rewards while participating in DeFi: Normally, if you set your token of choice as collateral to borrow a loan, your token is locked in a smart contract and you’re not entitled to any staking rewards (unless you put an LSD like stETH as collateral) until your loan has been fully repaid. With Cardano’s DeFi protocols such as:

Indigo protocol (synthetics), you can mint synthetic assets with ADA as collateral while your ADA is not locked and still accumulating delegation rewards with Indigo.

Liqwid protocol (lending), you can supply your ADA to earn ADA rewards not just from borrow interest, but also from delegation rewards.

Minswap (DEX), you can supply an (ADA-cardanotoken) to a liquidity pool and you’re also earning delegation rewards while farming your LPs for rewards.

DJED USD stablecoin, you can buy & hold their reserve coin called SHEN, which is utilized to stabilize the DJED stablecoin to 1 USD, to earn minting/burning fees and delegation rewards.

and these are just some examples how Cardano’s ADA delegation model can boost higher rewards across the whole DeFi ecosystem.

8. Helpful, Trusted & Mature Crypto Community

This point’s pretty subjective. All communities have crypto maximalism, or “maxi”s in short, which is an ideology that only one crypto or blockchain will rule the decentralized, peer-to-peer world and all other cryptos will eventually obsolete in thin air.

From my own experience, out of many L1 or L2 blockchain communities I have joined, Cardano community seems to be better in handling more mature discussions about the pros (and the cons) of the tech in their own blockchain. I also find it easier to ask questions about Cardano among the Cardano community that won’t get hit with a “FUD, YOU KNOW NOTHING, DO YOUR OWN RESEARCH” type of bullshit. Furthermore, I found a lot of Cardano people are more open to supporting other blockchains too as long as the fundamental properties of security & decentralization are there.

Other people may find similar open-minded people in other L1 blockchains, and I have also interacted with a few people from other L1 blockchain communities decent people to talk to, but to me I just find Cardano to have a slight edge in that category.

9. Stronger Community-Driven Governance Roadmap

Many L1 blockchains have their own on-chain governance whereby communities can submit proposals for blockchain parameter changes and end-users can vote them with their tokens.

For me, what gives Cardano an edge is the ability to vote and fund Cardano proposals, projects and technical development from a large treasury that is funded by 20% of each transaction fee paid in ADA with a project called Project Catalyst. You can register to vote for proposals with your ADA in your wallet, and you can still freely send your ADA while the voting process is ongoing as your voting power is determined based on a snapshot of your ADA holdings on a certain time and date.

Furthermore, CIP-1694 is an upcoming on-chain, community-driven governance model, whereby it has an organized structure that mimics real-world government systems with 3 different types of governing bodies:

Constitutional committee

Delegated Representative (DRep): Think of representatives that are responsible for voting on governance actions.

Stakepool Operators (SPO): Validators that secure the Cardano network.

This article gives a pretty good general overview on how CIP-1694 on-chain governance work on Cardano. Another great documentation on CIP-1694 is the Intersect Member-Based Organization (MBO)

C) 2024 Anticipations

1. Stronger Interoperability Roadmap

For years, Cardano is basically an island without strong connection to other blockchain ecosystems due to its unique functional programming in Plutus & the EUTXO model, while most other blockchains use Solidity & Rust languages and utilizing the accounts model.

Today, Cardano has many options to interoperate with many blockchains, such as

Milkomeda - a Cardano EVM sidechain that uses wrapped ADA to pay for tx fees, with a unique concept of wrapped smart contracts to which you can interact with a L2 or sidechain smart contract without the need to migrate your assets or your favourite NFTs from L1 to L2.

Wanchain - A decentralized, cross-chain interoperability solution that enables Cardano users access to assets from other chains such as Bitcoin, Ethereum & Avalanche, with a much better bridge security model of utilizing secure Multi-Party Computation (MPC) & nodes to validate transactions instead of multi-sigs which is more susceptible to hacks & loss of private keys & vault assets.

Rosen Bridge - Another cross-chain bridging solution that doesn’t utilize multisigs, but instead using the concept of “watchers” & “guardians” to validate cross-chain transactions that is much more secure.

Other platforms such as Dexhunter already has cross-chain swaps live where you can swap tokens such as SOL, ETH & MATIC to Cardano Native Tokens, while Cardano’s integration with Maya Protocol that utilizes the infrastructure of Thorchain to perform cross-chain native asset swaps is also in the works.

Midnight is also another privacy sidechain (or a “partnerchain”) to Cardano & other L1 blockchains which it also provides alternatives for users to shielding transactions that they don’t want to be public knowledge. The concept of partnerchains may also utilize Minotaur "multi-consensus protocol” & babel fees to pay transaction fees in another token other than the L1 token.

With all these options in the horizon, Cardano is definitely in a better position to attract liquidity from other L1 ecosystems to harness the power & benefits of the eUTXO model.

2. Scalability Development - Plutus V3, Hydra, Input Endorsers, etc.

Now, I can understand this is one of the issues that Cardano needs to keep up with as the current transaction speeds & fees on Cardano are still “not very fast” & “not comparatively cheap”. For the year 2024 onwards, I’m expecting updates & hopefully implementation on the following:

Plutus V3, the upcoming version update that enables more optimized smart contract scripts, resulting in 30% faster smart contract execution, while providing better support sidechains & bridges.

Hydra started to be used for the likes of payments for goods & services, day trading, games that regularly generating new moves / events, or voting.

The release of the Ouroboros Leios detailed paper that explains how it will scale the Cardano L1 with much faster tx speeds.

Leviathan by Optim Finance, basically a L2 on Cardano for fast finality, account-based transaction model that will increase speed, interoperability & user experience.

ZKFold, a scalability solution that uses zero-knowledge (ZK) proofs to build more efficient smart contracts & implementing rollups on Cardano.

I’m still hoping that we’re going to see at least one DApp that utilizes Hydra (or a slightly different version of Hydra like Gummiworm) this year, that is able to process significantly higher throughput especially on the trading side. Leviathan is also targeted to be shipped in Oct-2024 according to the tweet.

D) Summary

Cardano is currently one of my favourite chains to be in, due to strong native asset designs, low & predictable fees, easily readable transaction details, best ADA pool delegation user experience that doesn’t lock your stake, a well-diverse DApp ecosystem, a lot of DeFi innovations utilizing the power of eUTXO, community-driven governance model, a largely helpful & mature community and last but not least, one of the chains that I feel secure & very stable to use for the past 4 years.

While there are still tons of developments to work on for Cardano, such as being even more interoperable to other chains & implement good scalability solutions to increase transaction throughput, unlike most non-ADA communities out there, I’m still remain optimistic on its development and believed it’s still a top 10 chains for many years to come.

Good stuff!

Great write up man. 🫡