Weekly Pizza Bits #17 - 16-Jun-2023

1) Weekly Roundup of the SEC vs Crypto War #2

Starting from today, I’m going to provide weekly updates on the events related to the SEC vs crypto news, together with the regular Pizza bit updates. Each development shall bring closer towards deciding the fate of the cryptocurrency landscape in the US. I’ll post all the essential links for all the important discussions that you need to know to get yourself up to speed.

Without further ado, let’s begin.

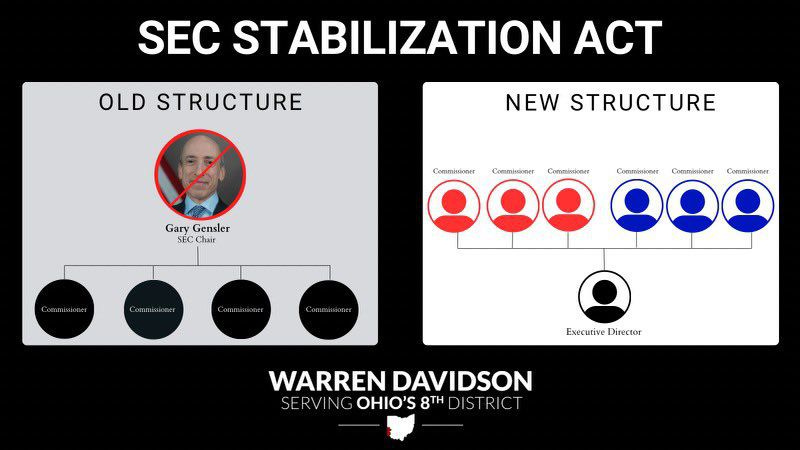

1a) Congressman Warren Davidson introduced a bill to restructure the SEC agency and fire SEC Chairman Gary Gensler from his post.

This legislation, as quoted by Congressman Davidson, is created to fix the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come.

For context, the current structure features 1 chairman & 4 commissioners under the chairman.

The bill will also restructure the commission to redistribute power from the chair to other commissioners, add a sixth commissioner to the body and create an executive director position to oversee ay-to-day operations.

From the comparison between the old & new structures above, we can see clearly how 1 chairman’s power will be replaced with 6 commissioners, while their responsibilities would still have rulemaking, investigative and enforcement authority and would be subjected to 6-year terms instead of 5.

In summary, you can say the power will be “decentralized” towards 6 people instead of 1, with no more than 3 people from 1 political party. This will also ensure that no one person shall simply enforce rules to crack down on projects without clear guidelines, whereby 6 commissioners from at least 2 different political groups will keep each other in check and have more collective discussions in creating better regulatory guidelines that will move the growth of the cryptocurrency ecosystem forward.

1b) Former SEC’s dierctor William Hinman’s email suggesting that ETH does not need regulation.

In light of the ongoing legal battle between Ripple XRP & the securities regulator, there is an email draft of the June 2018 speech made by the former SEC Division Director William Hinman. In the email draft, he stated that they “do not see the need to regulate ETH, as it is currently offered as a security”.

However, during the actual speech, he mentioned that Ethereum is not a security, as based on his understanding, the current offers and sales of ETH are not securities transactions, after he claimed that he will clarify with Vitalik on the understanding of how Ethereum Foundation operates before he came to this conclusion.

The funny thing about what is happening recently is that ETH has basically been given the green light to be branded not a security back then after they get clarifications from the Ethereum foundation, but we don’t see the SEC doing the same thing for other cryptocurrencies, while the SEC just straight up calling these cryptos as securities without spending more time to follow the same clarification process.

In my opinion, if the SEC claimed that other cryptocurrencies such as ADA, SOL & MATIC are securities, then I think ETH can also be classified as a security too, at least for these 3 reasons:

a) It has a burn mechanism that reduces the supply of ETH, which means that there’s clearly an expectation of profit from investing their money into ETH.

b) It has a pre-mine back in 2014, meaning ETH has been distributed to investors in exchange for BTC at a 1 BTC = 2,000 ETH price prior to the beginning of permissionless ETH mining system.

c) Investors gave up ETH to third-party centralized entities like Lido with the expectation of profits from ETH staking rewards derived from Lido. To add fuel to the fire, Bankless (a popular crypto media company) has also called upon ETH stakers to decrease reliance on Lido to prevent staking centralization. This just undermines the true properties of decentralization whereby investors prioritize profits over network security.

Now, I don’t want to come off as an ETH hater, but I think clear, unbiased regulation should be given for other cryptocurrency platforms to follow so that there will be a fair assessment towards differentiating whether cryptos are securities or not on a case-by-case basis, I think cryptocurrencies (including ETH and many other cryptos being called by the SEC as securities) are more fitted to be used as a currency or a commodity. You can check my previous article for more details.

2) Bank of China issues $28 Million in digital structured notes on the Ethereum blockchain.

For context, structured notes are investment products that offer a combination of features, such as fixed income, equity exposure, or derivatives, tailored to meet specific investment objectives. A digital form of structured notes will provide transparency, automation, and potential cost savings compared to traditional paper-based processes. By using blockchain, digital structured notes can enhance efficiency, reduce counterparty risk, and enable easier transferability and liquidity.

For the Bank of China to issue $28 million worth of digital structured notes, the Bank of China will be the first Chinese financial institution to issue a tokenized security in Hong Kong. Whether minting these tokenized securities on the Ethereum blockchain is a smart move or not remains to be seen, as transaction fees are pretty expensive compared to other blockchains and are unpredictable according to the network traffic.

3) Polygon announced a new version 2.0 with a lot of interesting upgrades

Polygon 2.0 is a proposed upgrade to the Polygon network that aims to build the Value Layer of the Internet, allowing for the creation, exchange, and programming of value in a decentralized manner. It envisions a set of upgrades to various aspects of Polygon, including protocol architecture, tokenomics, and governance. The goal is to enable decentralized finance, digital ownership, and new mechanisms for coordination on the platform.

One of the key features of Polygon 2.0 is the introduction of a network of ZK-powered L2 (Layer 2) chains, unified through a cross-chain coordination protocol. This network will provide unlimited scalability and unified liquidity, making the entire ecosystem feel like using a single chain for users. It addresses the scalability challenges faced by individual blockchains by allowing for the creation of multiple chains while maintaining liquidity and security.

The rollout of Polygon 2.0 is the result of extensive collaboration between Polygon Labs, developers, researchers, applications, node operators, validators, and the broader Polygon and Ethereum communities. Over the coming weeks, Polygon will release detailed information about each component of Polygon 2.0 through blog posts, community meetings, and AMA sessions. The Polygon community, which now has a formal governance process, will have the authority to accept and implement Polygon 2.0, making their involvement and participation crucial to the network's development.

Will definitely stay tuned for that.

4) Uniswap published a V4 whitepaper draft

Uniswap has published a new version V4 whitepaper draft with some major improvements on top of their last V3 upgrade that introduced concentrated liquidity.

Key features from Uniswap V4 include:

a) Hooks: Where anyone can create liquidity pools that can customize functionality such as managing the swap fee of the pool as well as withdrawal fees charged to liquidity providers.

b) Singleton: Where instead of each pool has to be created in separate smart contracts, this feature will aggregate all the pools into a single contract which reduces the cost of pool creation and multi-hop trades.

c) Flash accounting: A way to keep track of the transaction flow to ensure no tokens are owed to the pool. This feature works together with singleton to simplify the process of multi-hop trades thus reducing cost and will increase the number of pools.

d) Native ETH: Previously in Uniswap v2, due to implementation complexity and concerns of liquidity fragmentation across wrapped-ETH & native ETH pairs, they removed native ETH from the trading pairs so all ETH has to be wrapped to standardize ERC-20 token pairing. With Singleton & flash accounting, they are able to reintroduce native ETH back into the pools and thus further reduce the costs of wrapping & unwrapping ETH.

In summary, Uniswap v4 will bring more flexibility and higher cost reduction to perform swaps in Uniswap.

Subscribe to my Substack newsletter to receive quality crypto articles from a Malaysian’s perspective in your email!

Consider donating an affordable, decent meal monthly to support and grow my content further so that I’m able to introduce more features for the newsletter in the future!