Weekly Pizza Bits #6 - 1-Apr-2023

1. CFTC Filed a Complaint Against Binance

The allegations made by the Commodity Futures Trading Commission (CFTC) are:

Illegally operating crypto derivatives in the US, with connections to FTX.

Secretly coaching VIP customers on how to avoid compliance control.

Instructed its employees and customers to circumvent compliance controls in order to maximize corporate profits.

Binance CEO Changpeng Zhao has responded to those allegations, saying:

Binance implements a mandatory & high standards in KYC.

Binance has a large compliance team that handled 55,000+ Law Enforcement requests & assisted US Law Enforcement to freeze or seize a total of more than $285 million since 2022.

Binance does not manipulate the market and trade for profit

Deep down, we have always known there’s some shadiness in Binance’s business dealings, especially with multiple freeze of crypto withdrawals due to “network congestion”, or “down for maintenance”. Despite this, Zhao Changpeng seems to be a forward-thinking crypto person in my opinion and I totally respect his professionalism with the way he responded all of the allegations before this. If Binance were to be shut down, it will be a huge blow to the whole crypto industry in terms of bridging the gap between the crypto & fiat world. Furthermore, Binance owns a noticeable percentage of almost all of the popular cryptos such as Bitcoin, Ethereum, Cardano, Polygon and others.

2. NASDAQ’s Crypto Custody Services Coming Q2 2023

On the other side of the crypto regulation crackdown, we also have NASDAQ, one of the most popular global electronic marketplace for buying and selling securities, launching their crypto custody services by Q2 2023. The most probable cryptos that NASDAQ will provide custody to are Bitcoin & Ethereum.

Back in February 2023, SEC Chair Gary Gensler has stated that “everything else other than bitcoin is a security”, and that all cryptos need to follow the securities law. Since this claim is merely an opinion and not a law (as claimed by a crypto-advocate lawyer called Jake Chervinsky) and that all crypto cases must be proven in court, one at a time, before it can justified. In relation to the NASDAQ news, it would be interesting to see what other crypto assets can pass the SEC’s “Howey test” and can be listed on the NASDAQ.

3. Coinbase Moves to On-Chain Staking for Tezos, Cosmos, Solana & Cardano

So Coinbase is planning to support the PoS protocols by moving to on-chain staking, starting with Tezos, Cosmos, Solana & Cardano, after a “Wells Notice” has been handed to Coinbase by the SEC. This move will ensure the revenue comes directly from supporting the security of the respective blockchain networks, instead of the typical “lending out to institutions to earn a return”.

However, Coinbase neither specifies if users are able to choose their validators to stake, nor if all cryptos will be staked to their own validators/stakepools or to other validators/stakepools. On top of that, you need to be KYC-ed to be able to earn the rewards. Therefore, withdrawing your crypto assets to your own wallets and stake them would definitely be a better option as you will have the ability to choose your own validators/stakepools, while protecting your data privacy.

4. Zero-Knowledge Proofs Are Coming to Bitcoin

Zero-Knowledge Proof technology has been the talk of the town in many other blockchain platforms such as Ethereum & Polygon, and now several entities, including a Swiss non-profit called the ZeroSync Association is one of them that is currently developing zero-knowledge proofs for Bitcoin.

This will be a huge step forward for the sustainability of the Bitcoin blockchain. As the memory state of the blockchain size increases exponentially due to higher user adoption, coupled with Bitcoin’s massive block size of 1MB, users who wish to run a whole Bitcoin node would require to download a massive blockchain state size of ~469GB in your computer.

Zero-knowledge proofs will be important in significantly downsizing the state memory size of the blockchain by only requiring a very small size of cryptographic proof to download the entire history of transactions and balances, thus making it more efficient to run a Bitcoin node. An example of a blockchain that uses zero knowledge proofs to fixed their blockchain size to just 22kb regardless of any increase in transaction data storage is Mina Protocol. Highly recommended to deep dive into that protocol and also read about Mithril, which is also another solution of implementing a lightweight blockchain in Cardano.

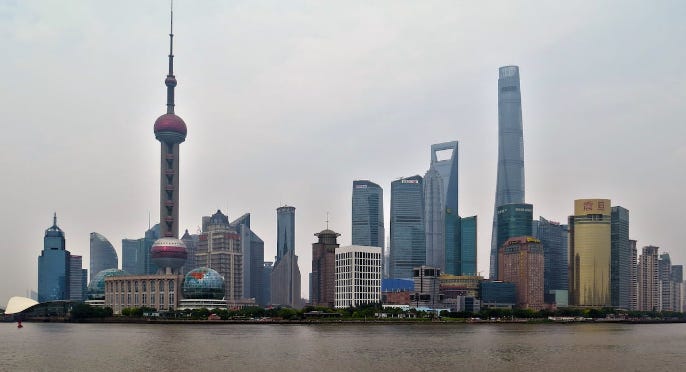

5. Chinese State-Owned Banks Are Now Backing Crypto Firms

In the opposite universe of governments cracking down on cryptocurrencies, China is definitely seizing its opportunity to lead the crypto markets by supporting China’s state-owned banks to reach out to crypto businesses.

Three banks, notably the Hong Kong arms of Bank of Communications Co, Bank of China and Shanghai Pudong Development Bank, have reportedly making inquiries and offering banking services to local crypto firms. With the adoption of the Digital Yuan, we may see integration of the Digital Yuan into a more permissioned DeFi environment, meaning the liquidity pools for Crypto-Digital Yuan pairs may be created to support blockchain-focused DEXes, or DeFi lending services.

The downside will be the Digital Yuan is fully traceable & controlled by the government, thus the freedom of the users may be threatened whereby any user who mentioned negativity stuff may cause the Chinese government to freeze your Digital Yuan. Nevertheless, embracing crypto technology is still a step forward rather than trying to get rid of the technology all together like the US.

Subscribe to my Substack newsletter to receive quality crypto articles from a Malaysian’s perspective in your email!

Consider donating an affordable, decent meal monthly to support and grow my content further so that I’m able to introduce more features for the newsletter in the future!