How Blockchain & Cryptocurrencies Technology Can Improve the EPF System, and Thoughts About Adding Crypto into EPF

1) What is EPF?

I’m sure everyone who works in Malaysia full-time will definitely heard of the term EPF. EPF stands for Employees Provider Fund. It is the essential place for every full-time working Malaysian to mandatory contribute part of their salary into an account for the purpose that you can withdraw them in the future and use it for your retirement. To the non-Malaysians, EPF is similar to a 401(k) retirement savings plan.

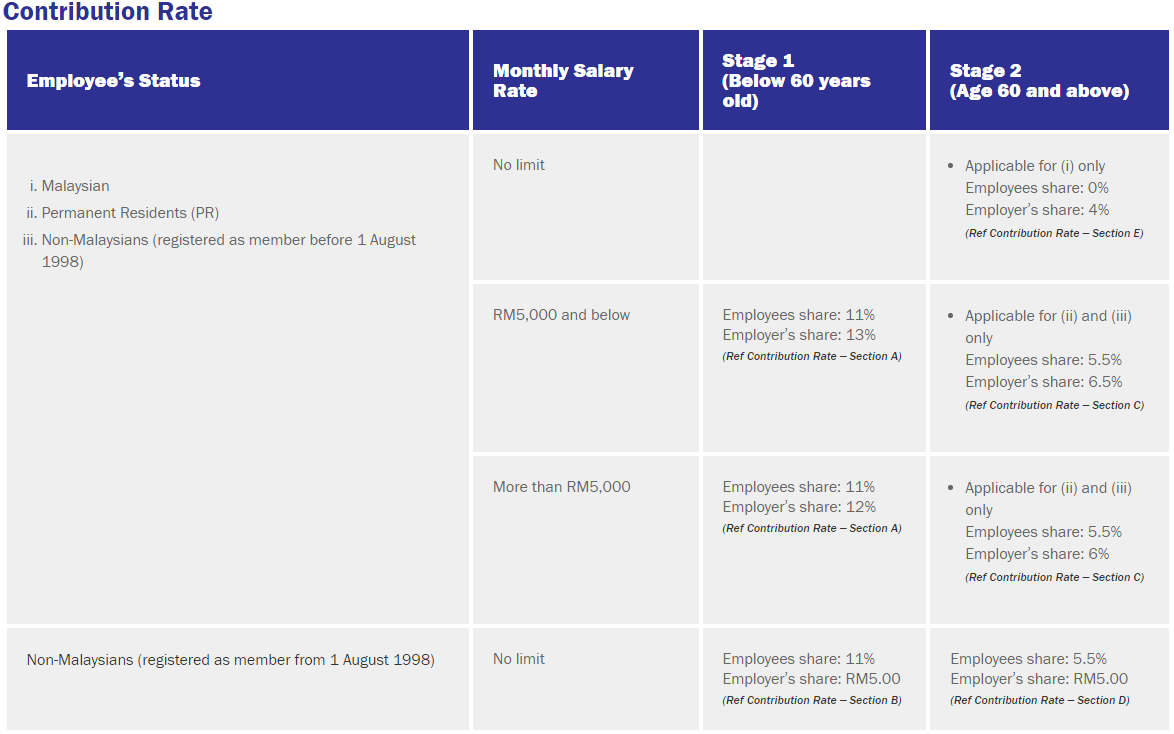

In Malaysia, the standard employee contribution percentage is 11% of the employee’s salary, while the employer must match at least 12% of the employee’s salary depending on the monthly salary income.

The salary contributions will be invested in local companies and the earnings will be paid to the contributors in dividends. The list of the top 30 equity companies invested by the EPF is here, where the companies are mostly from a mixture of real estate, banking, telecommunications & manufacturing sectors. These companies are well-established in Malaysia for many years, thus the risk of losing money compared to other higher risk assets such as stocks & cryptos. The minimum annual dividend rate that is declared by EPF is 2.5%. All-time high annual rate is 8.5% from the year 1983 - 1987, while the mean rate for the past 20 years since the year 2003 is approx. 5.7%.

These statistics showed that the returns for people investing and holding their money in EPF account generates better returns than other low-risk alternatives such as Fixed deposits and of course savings accounts. Besides that, investing in EPF will also:

Generate a stronger compounding effect on your wealth because your contributions are matched by your employers, so you’re getting slight > 2x of your savings in addition to the annual interests that you’ll earn yearly.

Develop a more passive & automatic savings habit.

However, the current EPF system also has its downsides.

2) Problems with EPF

(i) Locked funds

EPF accounts basically work like a locked staking feature mostly seen in Proof-of-Stake blockchains. The difference is just that your funds will be locked until you’re 55 years of age, and the funds are used to be reinvested in businesses instead of securing the blockchain network, so both have different use cases of using those locked funds.

This implementation actually creates a positive psychological effect that you know your funds are not withdrawable and you’ll tend to just forget it and let your funds sit in your account until you’re 55, thus my previous statement that you develop a more passive & automatic savings habit, while avoiding issues such as a bank run (for this case, large amount of people withdrawing their EPF savings at the same time.)

However, if you’re financially troubled, or if you just lost your job and you need funds urgently to cover your expenses, you cannot withdraw partially or all of your savings until you’re at least 55 years old, with a time-limited exemption of a special withdrawal facility up to RM10,000 for people aged below 55 has happened before to provide financial relief during the COVID-19 pandemic (which has already ended). This also brings to another downside.

(ii) Centralization

Even though the money inside your EPF account is yours, your funds are held in custody of EPF, so they decide, according to the current government’s policy, how you can access your funds. The worse thing that can happen with downside is if they plan to change this policy.

Recently, we have seen the news of protest in France about increasing the retirement age to 64 due to the rise in ageing population, which means more pension funds needed to be funded by taxpayer money, amplified by the France president invoking a special power to force the legislation through resulting in the protests.

Cases like these may also happen in Malaysia if unfavorable economic conditions are forced upon them to change policies.

3) Solution to improve the current EPF system with blockchain & cryptocurrency technology

Have you heard of “Time-locked withdrawals using smart contracts, with special conditions”?

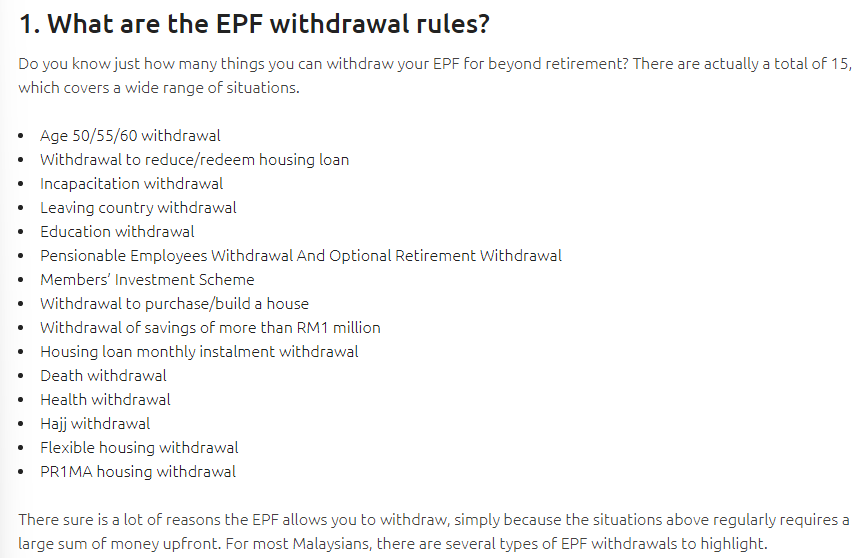

Instead of users filling up forms to middlemen like EPF to request for withdrawals, smart contracts will be useful in that users are able to cryptographically sign with their private key to withdraw their EPF money. The EPF withdrawal rules mentioned in the picture below can also be coded into a smart contract so that the code will automatically verify if your credentials meet the rule to process withdrawals.

This also eliminates the human error for the user & verifier, especially if the user falsely input the wrong information by mistake thus failing the verification process.

The money can be locked in an audited & secure smart contract that is programmed to release the full amount of your money to your self-custody wallet when you reach your retirement age.

Smart contract withdrawals are useful & efficient in that the withdrawal transaction is quick or almost instantaneous as long as all the conditions in the smart contract are met and also depending on the blockchain consensus design.

To feasibly implement this feature, wallets with self-sovereign identification with zero-knowledge proof technology must be used. This will provide private, but transparent enough verification to meet the withdrawal requirement such as:

Met the retirement age without revealing the exact birth date of the user.

Verifiable NFT that proves you have a housing loan without revealing exactly which house you bought to withdraw EPF funds for housing loan.

Verifiable NFT that proves you are admitted to a private school or university to withdraw EPF funds for education.

Verifiable credential that states that you have renounced your Malaysian citizenship without revealing your sensitive personal details in your IC (Identity Card)

And many more use cases that I didn’t mention here. You can read more info on how self-sovereign identification works in my previous article.

Alternatively, a multi-signature feature may be an attractive option for the EPF organization that requires more than 1 private key to authorize a withdrawal transaction. This means the EPF account owner (that is you) and one or a few members of the EPF organization will co-sign this transaction such that if the account owner is compromised, it’s harder for the hacker to drain the user’s retirement funds unless they are able to hold all of the private keys necessary to sign the transaction.

Add cryptocurrencies into EPF portfolio?

Before I continue this point, I want to be clear that I would never provide financial advice asking you to buy any particular cryptocurrencies. I believed that it’s possible to have this option of cryptocurrencies to be added in the i-Invest option alongside the other mutual fund investments listed. In the US, there’s also a crypto option for Individual Retirement Account (IRA). However, there’s currently no talks to add this option into EPF.

There are potentially two ways to implement crypto investment in your EPF account:

(a) Through a crypto fund management institution (Easier to implement for EPF but you have no direct control of your crypto holdings).

(b) Own them directly into your EPF account (Works like an exchange account, more control of your crypto holdings, but still in custodial of EPF).

Nevertheless, it’s good to have this option included especially if you believe the future of cryptocurrencies being used as an alternative form of money and medium of exchange for goods and services. Just like researching stocks, you’ll also need to research and understand the fundamentals of the blockchain technology, the developments, the team and the tokenomics for the crypto of your particular interest before you invest.

Summary

EPF or other equivalent retirement schemes are essential investment products to safeguard the future financial health of your well-being due to its significantly lower investment risk compared to other more speculative assets such as stocks & cryptos. With smart contract capabilities, the overall EPF system can be enhanced to provide more efficient withdrawal process while also using more privacy-focused ZK-proof self-sovereign identities.

Cryptocurrencies can also be a nice option to have in your EPF account, not just for diversification purposes, but also for the believe that they can be alternative forms of money to be used as medium of exchange for your retirement.

Subscribe to my Substack newsletter to receive quality crypto articles from a Malaysian’s perspective in your email!

Consider donating an affordable, decent meal monthly to support and grow my content further so that I’m able to introduce more features for the newsletter in the future!